It indicates the amount available from sales to cover the fixed expenses and profit. A person starting a new business often asks, “At what level of sales will my company make a profit? ” Established companies that have suffered through some rough years might have a similar question.

Get in Touch With a Financial Advisor

Read on to learn all about how break-even analysis can serve your small business. Revenues (or sales) at Oil Change Co. are the amounts earned from servicing cars. Oil Change Co. charges one flat fee of $24 for performing the oil change service. For $24 the company changes the oil and filter, adds needed what is the progressive consumption tax fluids, adds air to the tires, and inspects engine belts. The other expenses at Oil Change Co. (rent, heat, etc.) will not increase when an additional car is serviced. To make the topic of Break-even Point even easier to understand, we created a collection of premium materials called AccountingCoach PRO.

Break Even Revenue Calculator

The put position’s breakeven price is $180 minus the $4 premium, or $176. If the stock is trading above that price, then the benefit of the option has not exceeded its cost. Alternatively, the break-even point can also be calculated by dividing the fixed costs by the contribution margin. Let’s say that we have a company that sells products priced at $20.00 per unit, so revenue will be equal to the number of units sold multiplied by the $20.00 price tag.

- In other words, the no-profit-no-loss point is the break-even point.

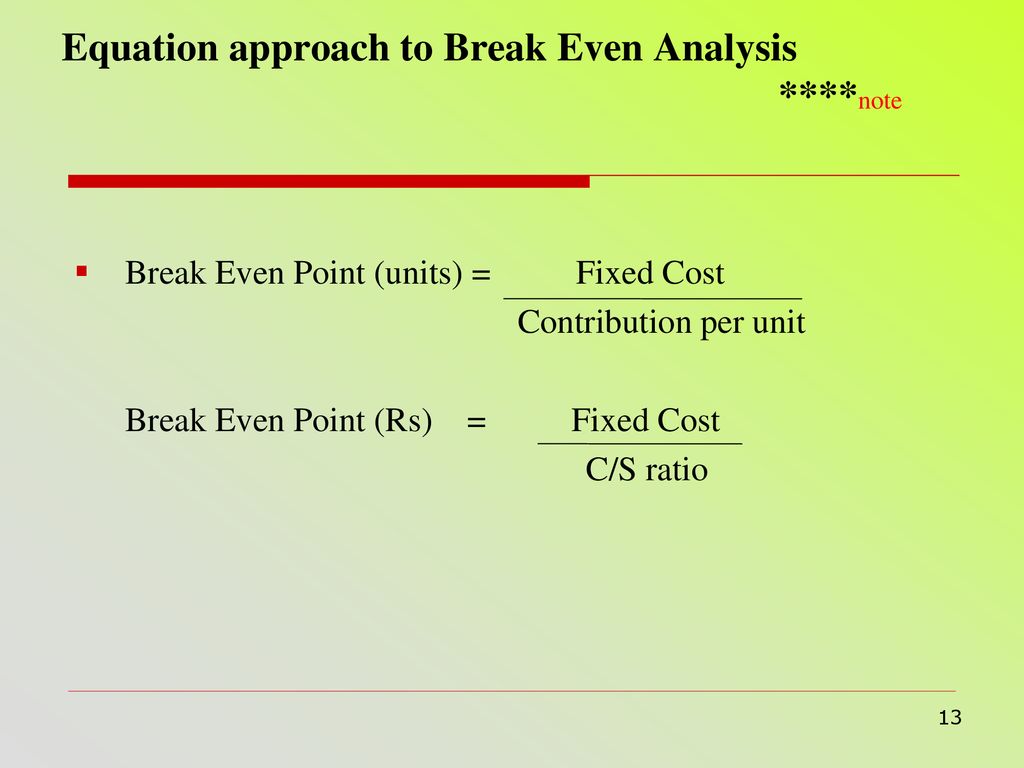

- The formula for break-even point (BEP) is very simple and calculation for the same is done by dividing the total fixed costs of production by the contribution margin per unit of product manufactured.

- With it, you can make your own predictions about what the future will bring and make a decision accordingly.

- It is essential in determining the minimum sales volume required to cover total costs and break even.

Formula

However, costs may change due to factors such as inflation, changes in technology, and changes in market conditions. It also assumes that there is a linear relationship between costs and production. Break-even analysis ignores external factors such as competition, market demand, and changes in consumer preferences. In contrast to fixed costs, variable costs increase (or decrease) based on the number of units sold. If customer demand and sales are higher for the company in a certain period, its variable costs will also move in the same direction and increase (and vice versa). The formula for calculating the break-even point (BEP) involves taking the total fixed costs and dividing the amount by the contribution margin per unit.

Which of these is most important for your financial advisor to have?

If sales drop, then you may risk not selling enough to meet your breakeven point. In the example of XYZ Corporation, you might not sell the 50,000 units necessary to break even. The break-even point is the number of units that you must sell in order to make a profit of zero. You can use this calculator to determine the number of units required to break even.

For example, if a product sells for $10 but only incurs $3 of variable costs per unit, the product has a contribution margin of $7. Note that a product’s contribution margin may change (i.e. it may become more or less efficient to manufacture additional goods). It is also possible to calculate how many units need to be sold to cover the fixed costs, which will result in the company breaking even. To do this, calculate the contribution margin, which is the sale price of the product less variable costs. Divide fixed costs by the revenue per unit minus the variable cost per unit. The fixed costs are those that do not change, no matter how many units are sold.

He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Knowing the break-even interest rate is important in comparing bonds. With it, you can make your own predictions about what the future will bring and make a decision accordingly. Some stocks are rather immune to inflationary pressure, while others can even benefit from inflation. In this case, the business would need to sell 101 T-shirts to break even.

When it comes to stocks, for example, if a trader bought a stock at $200, and nine months later, it reached $200 again after falling from $250, it would have reached the breakeven point. The break-even point is the volume of activity at which a company’s total revenue equals the sum of all variable and fixed costs. The break-even point is the point at which there is no profit or loss. Break-even analysis is great for entrepreneurs or companies that are just starting out and unsure of what to sell, how much to sell, or where to allocate their budget.

This means that the investor has the right to buy 100 shares of Apple at $170 per share at any time before the options expire. The breakeven point for the call option is the $170 strike price plus the $5 call premium, or $175. If the stock is trading below this, then the benefit of the option has not exceeded its cost. Finally, the breakeven analysis often ignores qualitative factors such as market competition, customer satisfaction, and product quality.

Launching a new product or service can be exciting but equally intimidating, especially when you’re unsure how much you’ll need to sell to cover your costs. It helps you figure out how many units you need to sell or services you need to provide to make sure your investment pays off. For instance, if your restaurant is introducing a new signature dish, you’ll want to know how many orders of that dish you need to sell to cover the costs of ingredients, staff time, and marketing. Break-even analysis looks at internal costs and revenues, but doesn’t factor in external influences that can impact your business. — e.g., changes in market demand, economic conditions, inflation, supply chain disruptions, etc. For instance, if shipping costs rise due to global supply chain problems, your variable costs might go up and can throw off your original calculation.

While the breakeven point is a valuable tool for decision-making, it has several limitations. One major downside is its reliance on the assumption that costs can be neatly divided into fixed and variable categories. In reality, some costs may not fit cleanly into these categories. For example, semi-variable costs, which have both fixed and variable components, can complicate the accuracy of the breakeven calculation which then changes the breakeven point in units.